New member here.

I'm going to consolidate/clarify the charging times for the e-Golf since I'm seeing a lot of posts and misinformation. Please correct me if I'm wrong and I'll update this post.

2017-2020 e-Golf has a 35.8 kWh battery.

2015-2016 e-Golf has a 24.2 kWh battery.

Charging time is based on year and model:

2017-2020 SE

Includes 7.2 kW charger(max charging rate is 6.6 kW) and SAE J1772 connector

AC Level 1 - (SAE J1772 connector to Standard NEMA 5-15 wall plug ) 110V/120V at Max 12 Amps - 110V and 120V reference the same thing. Approximate 100% Charge time ~ 29 hours

AC Level 2 - (SAE J1772 connector to Various home 220V/240V Connectors such as NEMA 6-20. 220V and 240V reference the same thing. If connecting to a public charger such as chargepoint or Blink, it will be either 220V/240V or 208V which are different. At 240V and 30 Amps or higher with no other vehicle sharing the station, Approximate 100% Charge time as low as 5.5 hours

DC Fast Charger - N/A

2017-2020 SEL

Includes 7.2 kW charger(max charging rate is 6.6 kW), SAE J1772 connector, and DC SAE Combo Fast Charger connector)

AC Level 1 - (SAE J1772 connector to Standard NEMA 5-15 wall plug ) 110V/120V at Max 12 Amps - 110V and 120V reference the same thing. Approximate 100% Charge time ~ 29 hours

AC Level 2 - (SAE J1772 connector to Various home 220V/240V Connectors such as NEMA 6-20. 220V and 240V reference the same thing. If connecting to a public charger such as chargepoint or Blink, it will be either 220V/240V or 208V which are different. At 240V and 30 Amps or higher with no other vehicle sharing the station, Approximate 100% Charge time as low as 5.5 hours

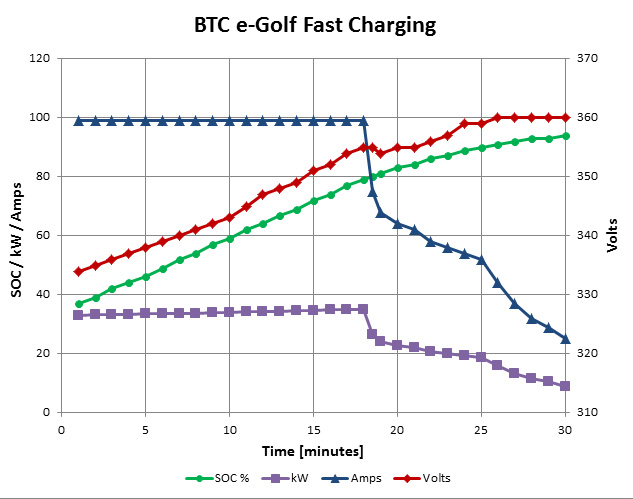

DC Fast Charger (mistakenly known as Level 3) - (SAE Combo connector to public fast charging station such as Blink DC Fast Charger or chargepoint Express) - Amps and Volts vary - Approximate 100% Charge time ~ between 40 minutes and 1.5 hour.

2016(SE without $1675 Fast Charging option)

Includes 3.6 kW charger(max charging rate is 3.2 kW) and SAE J1772 connector

AC Level 1 - Same as above. Approximate 100% Charge time ~ 20 hours

AC Level 2 - 100% Charge time takes longer due to the 3.6kW charger instead of 7.2kW. Approximate 100% Charge time ~ 7.6 hours

DC Fast Charger - N/A

2015(SEL or Limited Edition) or 2016(SEL or SE with $1675 Fast Charging Package)

Includes 7.2 kW charger(max charging rate is 6.6 kW), SAE J1772 connector, and DC SAE Combo Fast Charger connector)

AC Level 1 - (SAE J1772 connector to Standard NEMA 5-15 wall plug ) 110V/120V at Max 12 Amps - 110V and 120V reference the same thing. Approximate 100% Charge time ~ 20 hours

AC Level 2 - (SAE J1772 connector to Various home 220V/240V Connectors such as NEMA 6-20. 220V and 240V reference the same thing. If connecting to a public charger such as chargepoint or Blink, it will be either 220V/240V or 208V which are different. At 240V and 30 Amps or higher with no other vehicle sharing the station, Approximate 100% Charge time as low as 4 hours

DC Fast Charger (mistakenly known as Level 3) - (SAE Combo connector to public fast charging station such as Blink DC Fast Charger or chargepoint Express) - Amps and Volts vary - Approximate 100% Charge time ~ between 25 minutes and 1 hour.

Hope this helps!

I'm going to consolidate/clarify the charging times for the e-Golf since I'm seeing a lot of posts and misinformation. Please correct me if I'm wrong and I'll update this post.

2017-2020 e-Golf has a 35.8 kWh battery.

2015-2016 e-Golf has a 24.2 kWh battery.

Charging time is based on year and model:

2017-2020 SE

Includes 7.2 kW charger(max charging rate is 6.6 kW) and SAE J1772 connector

AC Level 1 - (SAE J1772 connector to Standard NEMA 5-15 wall plug ) 110V/120V at Max 12 Amps - 110V and 120V reference the same thing. Approximate 100% Charge time ~ 29 hours

AC Level 2 - (SAE J1772 connector to Various home 220V/240V Connectors such as NEMA 6-20. 220V and 240V reference the same thing. If connecting to a public charger such as chargepoint or Blink, it will be either 220V/240V or 208V which are different. At 240V and 30 Amps or higher with no other vehicle sharing the station, Approximate 100% Charge time as low as 5.5 hours

DC Fast Charger - N/A

2017-2020 SEL

Includes 7.2 kW charger(max charging rate is 6.6 kW), SAE J1772 connector, and DC SAE Combo Fast Charger connector)

AC Level 1 - (SAE J1772 connector to Standard NEMA 5-15 wall plug ) 110V/120V at Max 12 Amps - 110V and 120V reference the same thing. Approximate 100% Charge time ~ 29 hours

AC Level 2 - (SAE J1772 connector to Various home 220V/240V Connectors such as NEMA 6-20. 220V and 240V reference the same thing. If connecting to a public charger such as chargepoint or Blink, it will be either 220V/240V or 208V which are different. At 240V and 30 Amps or higher with no other vehicle sharing the station, Approximate 100% Charge time as low as 5.5 hours

DC Fast Charger (mistakenly known as Level 3) - (SAE Combo connector to public fast charging station such as Blink DC Fast Charger or chargepoint Express) - Amps and Volts vary - Approximate 100% Charge time ~ between 40 minutes and 1.5 hour.

2016(SE without $1675 Fast Charging option)

Includes 3.6 kW charger(max charging rate is 3.2 kW) and SAE J1772 connector

AC Level 1 - Same as above. Approximate 100% Charge time ~ 20 hours

AC Level 2 - 100% Charge time takes longer due to the 3.6kW charger instead of 7.2kW. Approximate 100% Charge time ~ 7.6 hours

DC Fast Charger - N/A

2015(SEL or Limited Edition) or 2016(SEL or SE with $1675 Fast Charging Package)

Includes 7.2 kW charger(max charging rate is 6.6 kW), SAE J1772 connector, and DC SAE Combo Fast Charger connector)

AC Level 1 - (SAE J1772 connector to Standard NEMA 5-15 wall plug ) 110V/120V at Max 12 Amps - 110V and 120V reference the same thing. Approximate 100% Charge time ~ 20 hours

AC Level 2 - (SAE J1772 connector to Various home 220V/240V Connectors such as NEMA 6-20. 220V and 240V reference the same thing. If connecting to a public charger such as chargepoint or Blink, it will be either 220V/240V or 208V which are different. At 240V and 30 Amps or higher with no other vehicle sharing the station, Approximate 100% Charge time as low as 4 hours

DC Fast Charger (mistakenly known as Level 3) - (SAE Combo connector to public fast charging station such as Blink DC Fast Charger or chargepoint Express) - Amps and Volts vary - Approximate 100% Charge time ~ between 25 minutes and 1 hour.

Hope this helps!